Financial Education

Black History Studies believes that financial education is very important and we aim to help families become debt free and financially independent. We do this through education to make the right choices via a variety of mediums

The BHS Financial Education Awareness Campaign is a campaign to increase community awareness about the importance of financial literacy and to make financial education available to everyone regardless of their background. Where possible, financial education should be free, fun and readily available to those who seek it.

We aim to help people to have greater confidence in making financial decisions. Anyone can grasp the concepts on how to take control of their money and make the right decisions today and in the future. We believe that everyone deserves to be empowered with the right information and education when it comes to their money.

Championed by Economics Graduate and Financial Educator Charmaine Simpson, we will use social media, website articles, videos, interactive seminars and courses, large events such as The Black Market & Film Festival, financial games and much more to spread awareness.

Inspired by the commemoration of the 150th birthday of Anne Malone and the 100th anniversary of the death of Madam CJ Walker who were the first female African American Millionaires.

Why Financial Education is important?

- It costs an average of £22.95 per day for a couple to raise a child from birth to the age of 18.

- For a lone parent family, the cost of raising a child comes to £27.90 per day.

- £59,713 is the average total debt per UK household in April 2019

- It would take 26 years and 9 months to pay off average credit card debt making only the minimum payment per month

- £2,653 is the average credit card debt per household in April 2019

- 350 people a day were declared insolvent or bankrupt in January to March 2019. This is equivalent to one person every 4 minutes and 7 seconds.

Source: UK money statistics from the Money Charity

Financial Education Events and Workshops

Please find below details of the upcoming Financial Education events and workshops delivered by Financial Educator Charmaine Simpson.

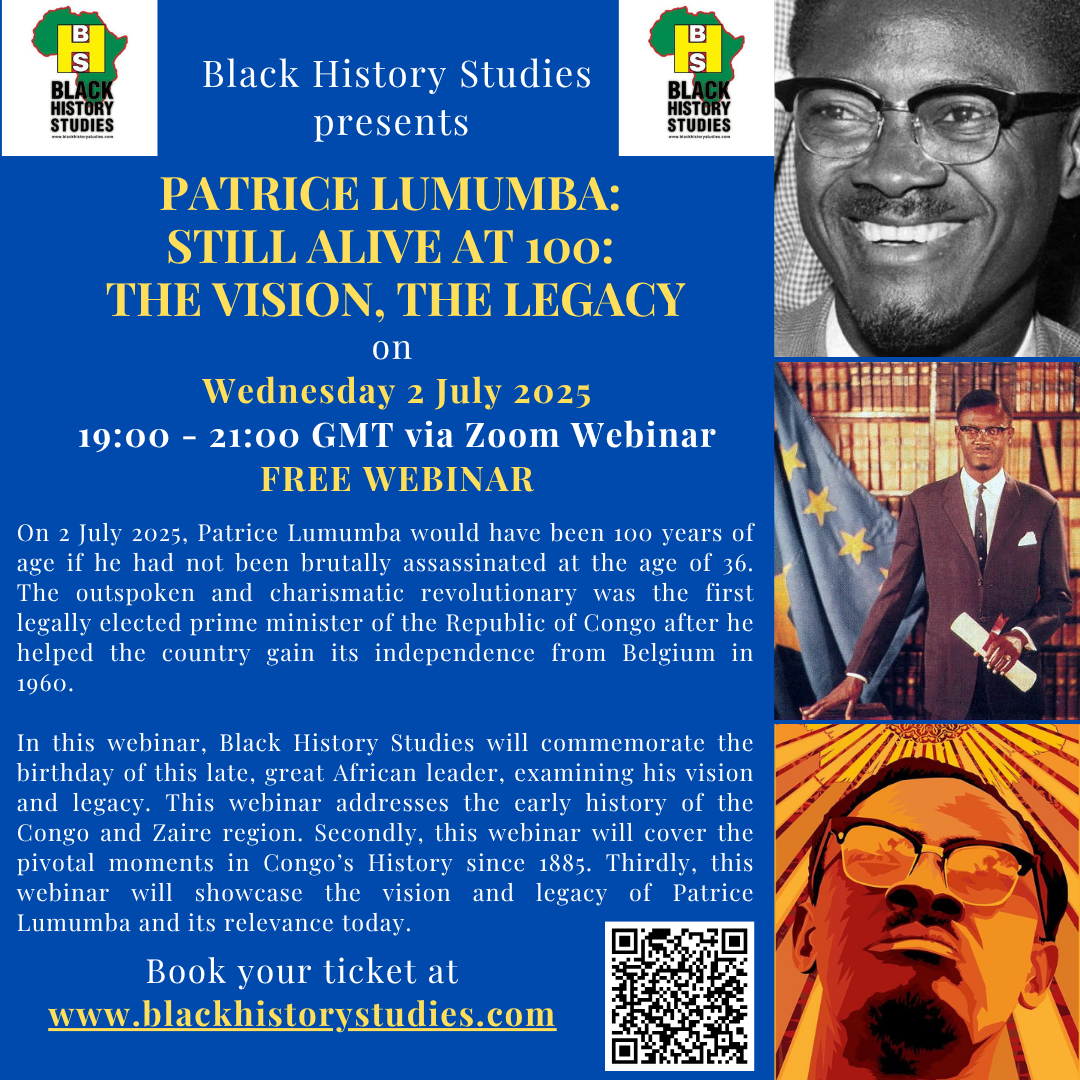

Black History Studies will deliver their informative webinar ‘Patrice Lumumba: Still Alive at 100: The Vision, The Legacy’ on Wednesday 2 July 2025. On 2 July 2025, Patrice Lumumba would have been 100 years of age if he had not been brutally assassinated at the age of 36. The outspoken and charismatic revolutionary was the […]FREE Webinar: Patrice Lumumba: Still Alive at 100: The Vision, The Legacy – Wed 2 July 2025