Financial Education

Black History Studies believes that financial education is very important and we aim to help families become debt free and financially independent. We do this through education to make the right choices via a variety of mediums

The BHS Financial Education Awareness Campaign is a campaign to increase community awareness about the importance of financial literacy and to make financial education available to everyone regardless of their background. Where possible, financial education should be free, fun and readily available to those who seek it.

We aim to help people to have greater confidence in making financial decisions. Anyone can grasp the concepts on how to take control of their money and make the right decisions today and in the future. We believe that everyone deserves to be empowered with the right information and education when it comes to their money.

Championed by Economics Graduate and Financial Educator Charmaine Simpson, we will use social media, website articles, videos, interactive seminars and courses, large events such as The Black Market & Film Festival, financial games and much more to spread awareness.

Inspired by the commemoration of the 150th birthday of Anne Malone and the 100th anniversary of the death of Madam CJ Walker who were the first female African American Millionaires.

Why Financial Education is important?

- It costs an average of £22.95 per day for a couple to raise a child from birth to the age of 18.

- For a lone parent family, the cost of raising a child comes to £27.90 per day.

- £59,713 is the average total debt per UK household in April 2019

- It would take 26 years and 9 months to pay off average credit card debt making only the minimum payment per month

- £2,653 is the average credit card debt per household in April 2019

- 350 people a day were declared insolvent or bankrupt in January to March 2019. This is equivalent to one person every 4 minutes and 7 seconds.

Source: UK money statistics from the Money Charity

Financial Education Events and Workshops

Please find below details of the upcoming Financial Education events and workshops delivered by Financial Educator Charmaine Simpson.

In remembrance of Political Activist Assata Shakur (1947 – 2025). This event explores the life, ideas, and enduring influence of Assata Shakur, former Black Panther Party and Black Liberation Army (BLA) member whose political thought continues to shape contemporary struggles against racism and state violence. Though Shakur has lived in political exile in Cuba for […] January is the month where the world comes together for Holocaust Memorial Day for the victims of the Jewish Holocaust. Contrary to popular belief, the Jewish genocide is not the first genocide of the 20th century. 2026 will be the 142nd year anniversary of the partitioning of Africa among European countries in the late 19th […] Black History Studies presents FREE Webinar – Against Erasure: Black Victims and Resistance to Nazism This webinar highlights the often-forgotten history of Black victims of the Nazi era while also honouring Black individuals who resisted Nazi oppression. It will explore how Nazi racial ideology targeted Black communities through discrimination, forced sterilisation, imprisonment, medical abuse, and […] Black History Studies presents FREE webinar on ‘An Afro-Caribbean in the Nazi Era: Oral History and the Black Family’ An Afro-Caribbean in the Nazi Era: Oral History and the Black Family Presented by Mary Romney-Schaab How did an Afro-Caribbean civilian merchant sailor become a prisoner in a Nazi concentration camp during World War II? What […]FREE Presentation – Assata Shakur and the Struggle for Black Liberation – Sat 10 January 2026

FREE Webinar: The Scramble for Africa – African Resistance and German Colonialisation & Genocide in Namibia – Sun 25 Jan 2026

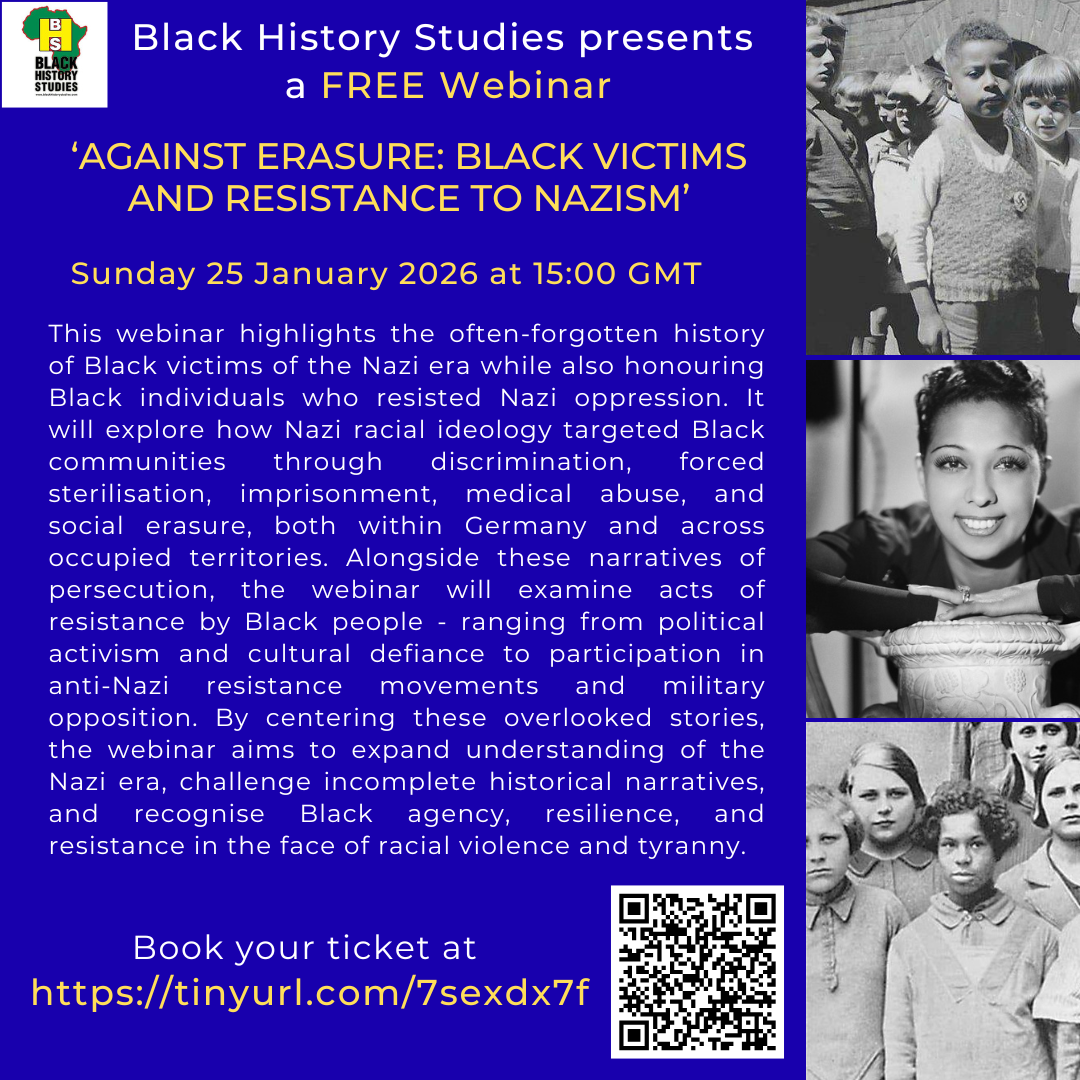

FREE Webinar – Against Erasure: Black Victims and Resistance to Nazism – Sun 25 January 2026

FREE: An Afro-Caribbean in the Nazi Era: Oral History and the Black Family – Sun 15 February 2026